Calculating child support in San Antonio, Bexar County, depends on a number of factors. One of the biggest factors is income, what is counted as income vs what is not, and what can be deducted from that income to reduce child support.

Step 1: Begin to determine what income to include in your calculation:

Do include

- One hundred percent of all wage and salary income and other compensation for personal services (including commissions, overtime pay, tips, and bonuses);

- Interest, dividends, and royalty income;

- Self-employment income;

- Net rental income (rent after deducting operating expenses and mortgage payments, but not including non-cash items such as depreciation); and

- All other income actually being received, including severance pay, retirement pay, pensions, trust income, annuities, capital gains, social security benefits, unemployment benefits, disability and workers’ compensation benefits, interest income from notes regardless of the source, gifts and prizes, spousal maintenance, child support, and alimony.

Do not include:

- Return of principal or capital on a note not included in net resources;

- Accounts receivable;

- Benefits paid through Temporary Assistance for Needy Families (TANF);

- Payments for foster care; or

- Net resources of a new spouse.

Step 2: Divide the annual gross income by 12. This will get your the average monthly gross income.

Step 3: Subtract the following from the average monthly income to give you the average monthly net resources:

A great resource to help calculate the tax deduction is the 2018 Attorney General Tax Chart.

- Federal income taxes paid for a single person claiming one personal deduction and the standard deduction;

- State income taxes;

- Social security taxes

- Union dues; and

- Child’s health insurance cost or cash medical support.

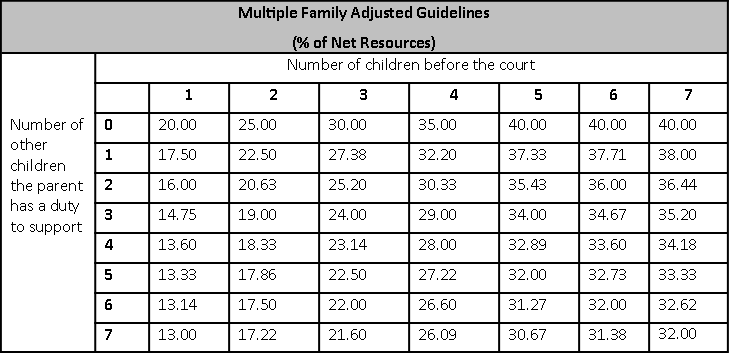

Now the fun part, apply the applicable percentage for the number of children to the average monthly net resources.

If your net monthly resources exceed $8,550, then a different calculation may be necessary if the child’s proven needs are greater than the presumptive guidelines amount.

If all of these calculations seem a little bit confusing, use the Attorney General’s child support calculator to give you an idea of what you may owe in child support.